Travel tax a new Coalition fault line

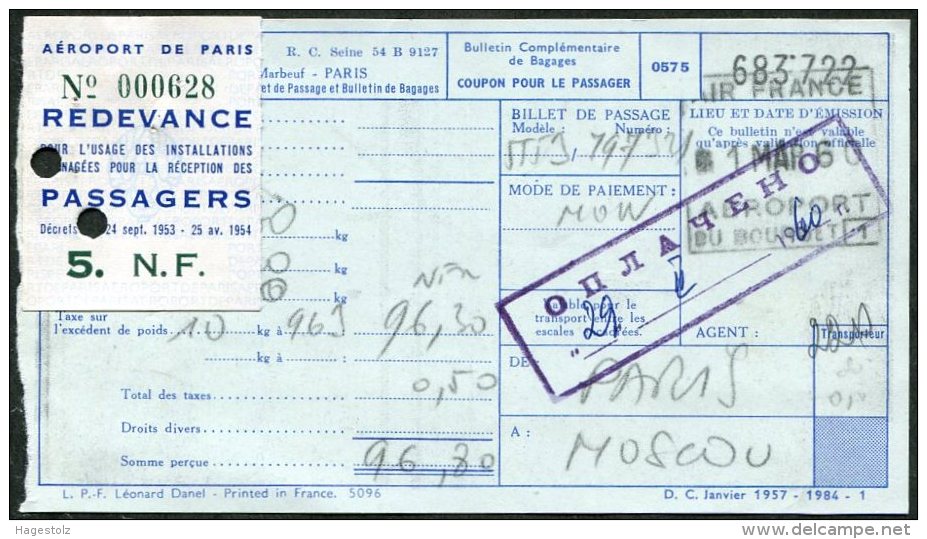

Departure taxes were once quite easy to spot, paid on departure in cash. Now they are hidden in the airline ticket price.

How the $5 hike to the departure tax underscores deeper divisions within the government on foreign tourists

The timing of the backpacker tax climbdown, coinciding on Monday with the US presidential debate, should have set alarm bells ringing. The reversal was not only a win for the National Party within the Coalition party room, but also for the economic conservatives from within the Liberal Party, for whom international tourism is viewed with scepticism.

The amendment of the foreign workers’ taxation arrangements was coupled with an increase to Australia’s departure tax, euphemistically called the Passenger Movement Charge (or PMC). The PMC is an excise tax on every adult passenger departing an international airport or seaport. Successive governments have viewed the tax as a soft target, not least since the levy is included in airline ticket prices.

But in 2012 the tourism industry, in a rare moment of unity, managed to reverse a Labor plan to increase the tax annually. In doing so, we also secured a written pledge from the Coalition not to increase the tax were they to enter government.

This pledge contained a get-out clause limiting the promise to the 44th parliament. Just two months into the 45th parliament, we now know the real value of that pledge. The $5 increase to the PMC is a over a dollar greater than would have occurred under the inflation-indexed increases the Coalition so enthusiastically opposed.

As part of small team that secured the blocking of the annual increases, I can offer some insight into the split thinking within the Coalition. The Nationals, along with the right wing of the Liberals, believe that any increased taxation on international travel will encourage more domestic tourism. The economic liberals on the left of the Liberal party, meanwhile, recognise the economic contribution that tourists bring to Australia. Of course, most of these foreign visitor dollars flow to inner-city electorates.

Yet, that the economic conservatives were able to reverse the position of the centrists on this tax should not be overlooked. The PMC is already the second highest departure tax in the OECD and it is highest in the world for short-haul travel. A 760km trip from Darwin to Dili attracts the same tax as the 12,600km Sydney to Dallas route. By contrast, other countries with high taxes on international air travel, such as the UK and Germany, distance-tier their levies.

The PMC over-recovers against its stated objective of offsetting the cost of border protection and biosecurity checks. As illustrated this week in the rolling strikes by Australian Border Force personnel, the automation of passport control is contentious. So far self-service border controls have proved both cheaper as well as more effective than employing frontier staff to check travel documents. Further use of technology for customs and quarantine checks should reap similar economic gains that ought be returned to travellers the form of lower departure taxes.

The PMC depresses demand for travel to Australia. The International Air Transport Association estimates that Australia would see over 3% more visitors each year were the tax abolished. There had been hope that the economic rationalism that led to the Netherlands abandoning its modest departure tax (after it lost two million passengers in a single year) would percolate here. Instead, the government’s favourite cash cow has been milked again.

There are far more sophisticated ways to raise the revenue required to fund both the destination marketing of Australia and also our border processing. The government is, for example, likely to be handed a $1 billion windfall in 2017 when reciprocity rules will allow it to charge Europeans for visitor visas. Logic has it that this should be redirected to reducing the $140 fee most Asians have to pay to enter this country.

Yet Treasury is usually deaf to logic and the tourism industry is again disunited and unable to mount an effective campaign.

This is in contrast to the agricultural lobby, which has to be congratulated in its crusade against the backpacker tax. By understanding the emotional appeal of foreign fruit pickers to regional Australia and also playing the factional politics within the Coalition ranks, the farmers have pulled off something the tourism industry could not. Here’s to the Nationals!